To manage your small business finances effectively, tracking expenses is essential. Your business’s financial health is better understood when expenses are accurately recorded, and tax laws are adhered to.

As part of this blog, we will explore the steps involved in tracking small business expenses, discuss the best methods for tracking, and highlight the benefits of using an app like Bookipi Expense.

How to track expenses for small business

In your day-to-day operations as a mechanic, efficiency and organization are essential. It’s crucial not to overlook the financial aspect of your business while you focus on servicing vehicles. Bookipi simplifies bookkeeping as a mechanic, which we’ll explore in this blog.

Maintaining accurate records of your business finances can be made easier by streamlining your bookkeeping processes. If you prefer physical invoices over digital invoices, download and use our free editable mechanic invoice templates instead.

Steps for tracking small business expenses

Step 1: Establish an expense tracking system

Implementing a solid expense tracking process is the starting point for effectively track expenses for your small business. You can use various tools such as spreadsheets, accounting software, or dedicated expense tracking apps like Bookipi Expense.

Step 2: Categorize your expenses

Categorizing your expenses into different categories such as office supplies, utilities, marketing, travel, and more, is helpful to stay organized as a small business. You can then easily view spending patterns and assess where your business is spending most.

Step 3: Capture receipts

Accurate record-keeping requires capturing and storing receipts for all business-related expenses. You can maintain physical copies or digitize receipts with scanners or mobile apps like Bookipi Expense. Your receipts should contain all relevant information, including transaction date, vendor details, item description, and amount.

Step 4: Keep up-to-date expense records

Consistency is key when it comes to expense tracking. It’s helpful to allocate time each week or month to review your expenses, reconcile your statements with your expense records, and follow up on any discrepancies. Regular reviews of your expenses helps prevent potential errors in your financial reports.

Step 5: Reconcile bank and credit card statements

Reconcile your business bank and credit card statements with your recorded expenses. This step helps maintain the integrity of your financial data and provides a clear picture of your business’s financial standing.

What is the best way to track expenses for the self-employed & small businesses?

When it comes to tracking expenses, self-employed individuals and small business owners have several options. Each method has its pros and cons, and it’s important to choose the one that suits your business’s needs and resources.

Here are a few commonly used methods:

Excel Spreadsheet

Using an Excel spreadsheet is a cost-effective way to track expenses. It allows you to create customized templates, categorize expenses, and perform basic calculations. However, it may lack advanced features and automation, which can make it time-consuming and prone to human error.

Expense tracking apps

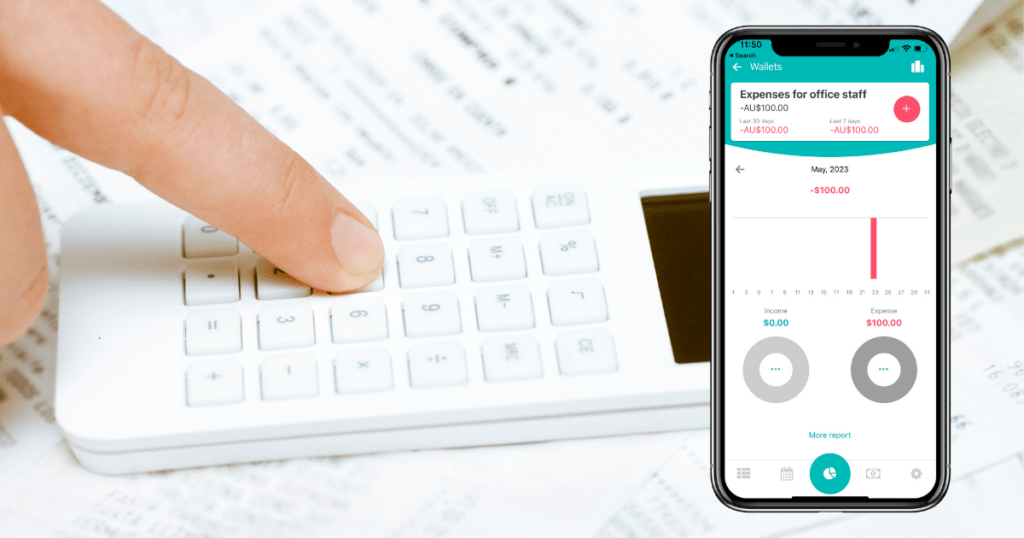

Expense tracking apps, like Bookipi Expense, offer a user-friendly and mobile solution for tracking expenses on the go. Our free expense app has cloud storage, real-time expense monitoring, and bank feed integrations.

Check our the Bookipi Expense user guides to help you navigate all of our features effectively.

How do I track income for my small business?

Tracking income for your small business follows a similar process to tracking expenses. Here are a few steps to help you keep a record of your small business income:

Step 1: Create invoices

It’s best small business practice to send professional invoices to your clients promptly at the completion of a transaction. You should include relevant details on your invoice such as the products or services provided, pricing, payment terms, and due dates. This ensures clear communication and helps in tracking your receivables. Use invoice maker apps like Bookipi Invoice to make and send pre-designed invoices in minutes.

Step 2: Record payments

You’d want to maintain accurate records of any payments received from your customers. Use accounting software, spreadsheets or an invoice app like Bookipi to document the payment date, paid amount, customer details, and any associated invoices. It’s easy to get paid on time with Bookipi’s integrated online card payments. Payments record-keeping helps you identify any outstanding payments and preserve your small business’ cash flow.

Step 3: Reconcile bank accounts

Regularly compare your bank account with the income recorded in your financial records. You can also try Bookipi’s cash flow manager feature for free in our mobile app. This is important to ensure all income is accurately accounted for so you can identify any missed transactions.

What are the benefits of using an expense tracker app?

Using an expense tracker app like Bookipi Expense offers numerous benefits for small business owners including the following:

Time savings

Expense tracker apps automate and simplify the expense tracking process. Features such as receipt scanning, automatic categorization, and cloud storage save you time so you can focus on growing your small business.

Accurate records

Expense tracker apps minimize the risk of manual errors and ensure accurate record-keeping. By eliminating the need for manual data entry and calculations, they help maintain reliable financial records for tax purposes and decision-making.

Financial insights

With real-time expense monitoring and robust reporting features, expense tracker apps provide valuable insights into your business’s financial health. Identify cost-saving opportunities, analyze spending patterns, and make informed financial decisions.

Keeping track of expenses is essential for small business owners. Consider using an app like Bookipi Expense to save time, and get a full picture of your expenses in one spot.