What’s the difference between pro forma & commercial invoices?

Whenever you ship goods internationally, it’s important to understand the difference between a pro forma invoice and a commercial invoice. Both documents are used to track the sale of goods, but they serve different purposes.

What is a pro forma invoice

A pro forma invoice is a document that is sent to a buyer before the goods are shipped. It provides an estimate of the cost of the goods, as well as the terms of payment. The pro forma invoice is not a legal document, but it can be used to secure financing or to get a letter of credit.

What is a commercial invoice

A commercial invoice is a document that is sent to a client after the goods or services have been supplied. A commercial invoice lists the actual cost of the goods and payment terms. The commercial invoice is a legal document that is used to clear customs and to track the sale of goods.

The table below summarizes the key differences between pro forma and commercial invoices:

Pro Forma Invoice | Commercial Invoice |

Sent before the goods are shipped | Sent after the goods are shipped |

Provides an estimate of the cost of the goods | Lists the actual cost of the goods |

Not a legal document | A legal document |

Used to secure financing or to get a letter of credit | Used to clear customs and to track the sale of goods |

Should I use a pro forma invoice or a commercial invoice?

The type of invoice that you use depends on the specific circumstances of your transaction. If you are shipping goods internationally, you will likely need to use both a pro forma invoice and a commercial invoice.

The pro forma invoice will be used to secure financing or to get a letter of credit. The commercial invoice will be used to clear customs and to track the sale of goods.

If you are shipping goods domestically, you may only need to use a commercial invoice. However, it is always a good idea to check with your freight forwarder or customs broker to make sure.

Can I use a pro forma invoice instead of a commercial invoice?

While a pro forma invoice is useful for providing an estimate of the cost of goods or services, it cannot be used as a substitute for a commercial invoice. A commercial invoice is a legal document that is required for customs clearance and is used to calculate duties and taxes. If you’re shipping goods to another country, you will need to provide a commercial invoice to the customs officials in the importing country.

Essential items to list on a pro forma invoice

- Invoice number

- Date

- Seller’s name and address

- Buyer’s name and address

- Description of goods

- Quantity of goods

- Unit price

- Total price

- Payment terms

- Shipping terms

- Contact information

Essential items to list on a commercial invoice

- Invoice number

- Date

- Seller’s name and address

- Buyer’s name and address

- Country of origin

- HS code

- Description of goods

- Quantity of goods

- Unit price

- Total price

- Freight and insurance

- Customs duties and taxes

- Payment terms

- Shipping terms

- Contact information

In addition to the essential items listed above, there may be other items that are required or customary for a particular country or industry. It is always best to check with the buyer or your freight forwarder to make sure you have all of the required information.

Additional tips for creating a pro forma invoice or commercial invoice

- Ensure that the invoice is complete with all necessary information

- Double-check all of your information for accuracy.

- Use clear and concise language.

- Use a consistent invoice format.

- Make sure your invoice is easy to read.

- Proofread your invoice carefully before sending it to the buyer

- Keep copies of the invoices for your records.

By following these tips, you can create a pro forma invoice or commercial invoice that is accurate, professional, and easy to understand.

Benefits of using Bookipi invoice app

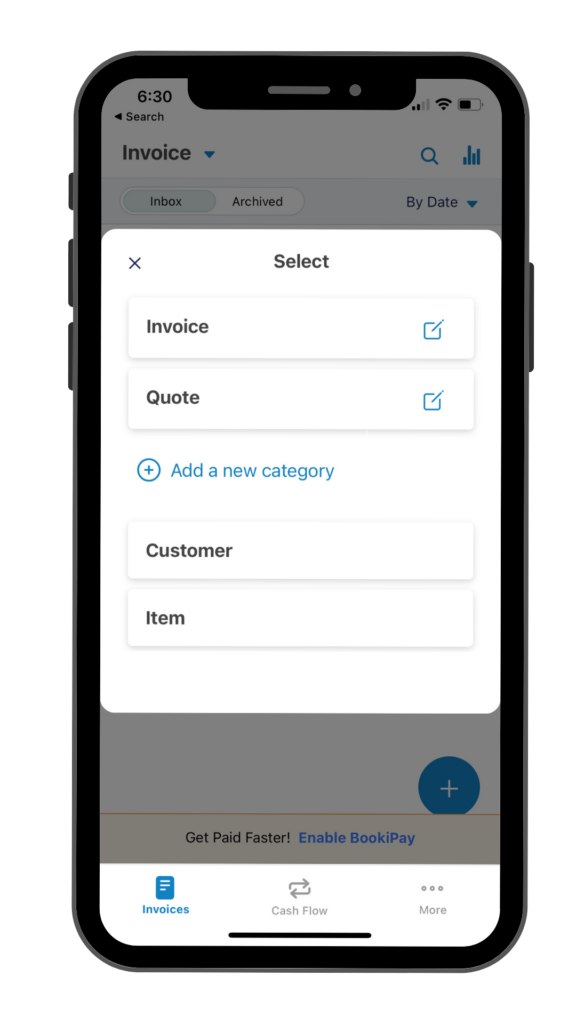

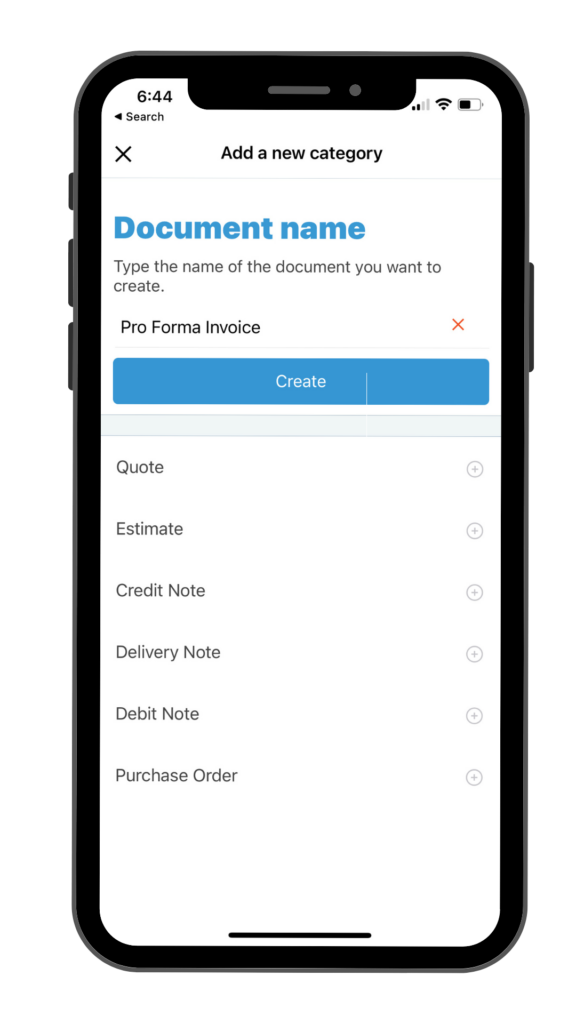

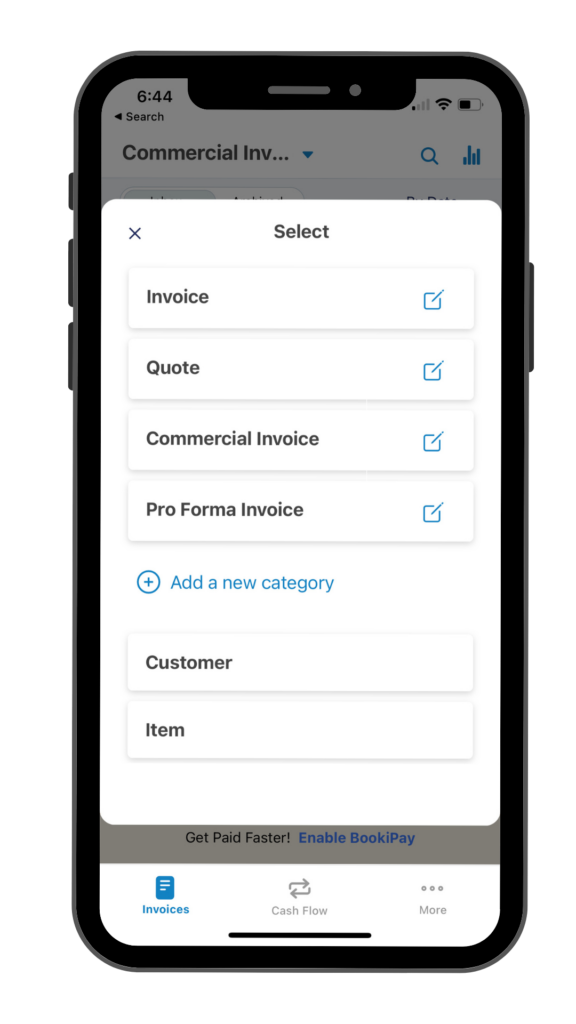

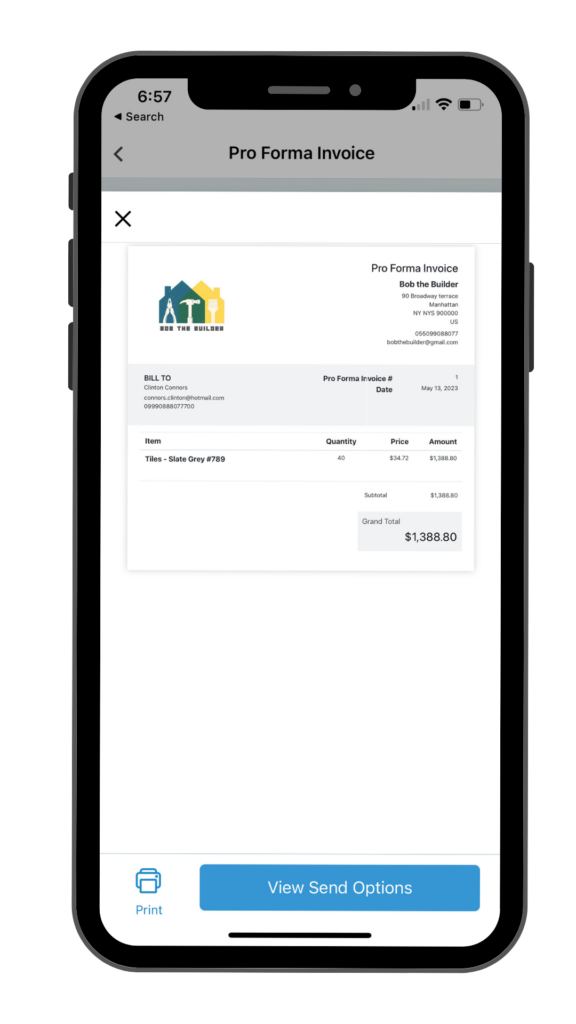

Create a pro forma invoice with Bookipi

- Easy to create – Make invoices using Bookipi invoice app in minutes. You don’t need to be an accounting expert.

- Customizable – Bookipi invoices can be customized to meet your specific needs.

- Affordable – Make invoices for free using the mobile app or try web app for free.

If you’re looking for invoicing software that can help you create both pro forma and commercial invoices, then Bookipi Invoice app is a great option.