If you’ve ever wondered how to set clear expectations with your clients before a sale is finalized, a proforma invoice is your answer. Making this invoice helps small businesses streamline negotiations and keep both buyers and sellers aligned.

In this guide, I’ll walk you through what a proforma invoice is, why it matters, and how you can use it to make your business operations smoother and more professional.

What is a proforma invoice?

A proforma invoice is a preliminary bill of sale you send to clients before delivering goods or services. It’s not a final invoice, but a detailed estimate that sets expectations and helps both sides agree on price, quantity, and delivery terms. Think of it as a handshake before the paperwork. It keeps everyone on the same page and avoids surprises down the line.

When you’re running a business, you want to make sure your clients know exactly what they’re getting and what it will cost. That’s where a proforma invoice shines. It’s especially useful for international sales, as customs officials often need it to assess duties and taxes. But even if you’re only selling locally, sending a proforma invoice can speed up approvals and reduce back-and-forth emails.

Learn more about proforma here: Investopedia

What is the purpose of a proforma invoice?

A proforma invoice is more detailed than a simple quote, listing everything a buyer needs to know before making a final decision. That includes prices, quantities, shipping costs, taxes, and delivery dates.

Let’s say you’re a freelance designer. You send a proforma invoice outlining the project scope, deliverables, and price. Your client reviews it, approves, and you both move forward with confidence. If anything changes, you update the document. It’s flexible, clear, and keeps misunderstandings to a minimum.

Other uses of a pro forma invoice include:

- Pro forma invoices declare the value of goods for customs for an easy delivery process

- Pro forma invoices are issued when you don’t have all the details needed for a commercial invoice

- Clients use pro forma invoices to get internal purchase approval

What should you include in a proforma invoice?

Clients often worry about missing something important. Here’s a checklist I use:

- Header: “Proforma Invoice” in big, bold letters

- Your business info: Name, address, contact details

- Client details: Name, address, contact info

- Invoice number and date

- Itemized list: Description, quantity, unit price

- Subtotal, taxes, shipping, discounts

- Payment terms and conditions

- Delivery date and shipping info

- Any special notes or disclaimers

Always double-check your numbers and details. A mistake here can slow down approvals and delay your payment. Take note that you need to clearly display the words ‘Proforma Invoice’ in your invoice template so your customers know that it is not a sales or tax invoice.

What’s the difference between a pro forma invoice and standard invoice?

An invoice is a commercial document that outlines what goods and services were provided and the total amount due for those goods and services, while a proforma invoice is like an estimate and details the goods and services that will be provided to a seller. A proforma invoice is sent before the actual supply of goods and services and tells a customer what they can expect.

I see this mix-up all the time, so here’s a table to clear the differences between proforma and commercial invoices:

| Aspect | Proforma Invoice | Commercial Invoice |

|---|---|---|

| When it is issued | Before delivery or completion | After delivery or completion |

| Legally binding | No | Yes |

| Used for accounting | No | Yes |

| Purpose | As an estimate or quote | For payment and accounting |

Both pro forma invoices and commercial invoices are formatted similarly. Both show the same information including business logo, contact information, billing addresses, information about the goods and services, costs, as well as terms and conditions. However, a proforma invoice should be clearly labelled ‘proforma’.

You can use an invoice for accounting purposes but you can’t use a proforma invoice because this occurs prior to the actual sale.

Can you turn pro forma invoices into commercial invoices?

No, you cannot convert pro forma invoices into commercial invoices. While both documents contain similar information, a commercial invoice is a legally binding document that includes specific terms and conditions related to the sale, which are not present in a pro forma invoice.

Proforma invoices simply serve as preliminary estimates and do not obligate either party to complete the transaction, whereas commercial invoices are required for customs clearance and payment processing.

Find out more about payment methods: afponline.org

Is a proforma invoice legally binding?

A proforma invoice is not legally binding and should not be used for accounting purposes. As it is sent before goods and services are provided, it is closer to an estimate or quote than an invoice.

No sale has occurred when you send a proforma invoice.

Can a proforma invoice be cancelled or changed?

Yes, proforma invoices can be cancelled. Since a proforma invoice isn’t a legal document, you can update or cancel it anytime. If your client changes their mind or you need to adjust the order, just send a revised version. No fuss, no paperwork, just clear communication.

How to make a pro forma invoice using Bookipi

You can generate invoices and more on the Bookipi Invoice app with a few simple steps listed below:

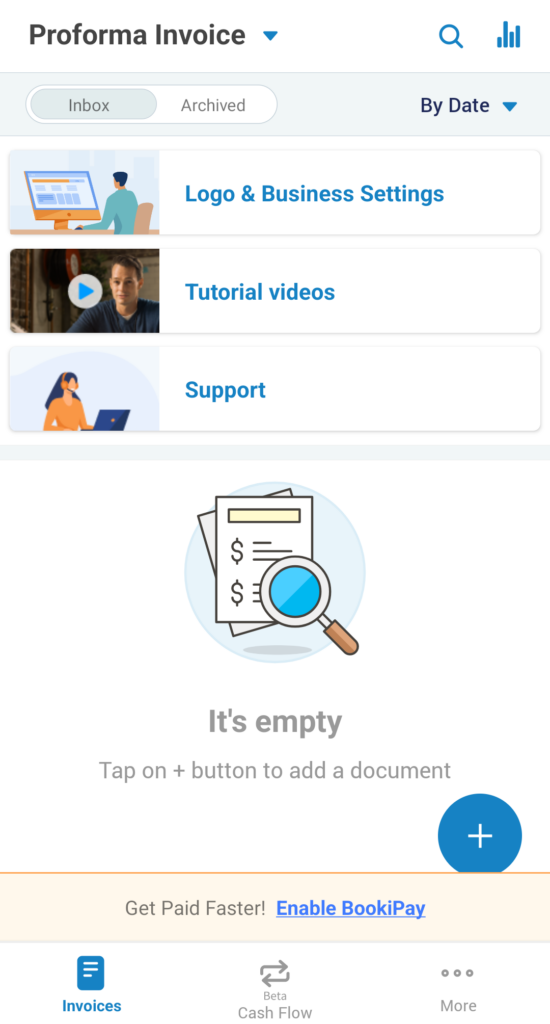

Step 1: Make a new pro forma invoice

Press the ‘plus’ button to make a new invoice in Bookipi’s invoice tool.

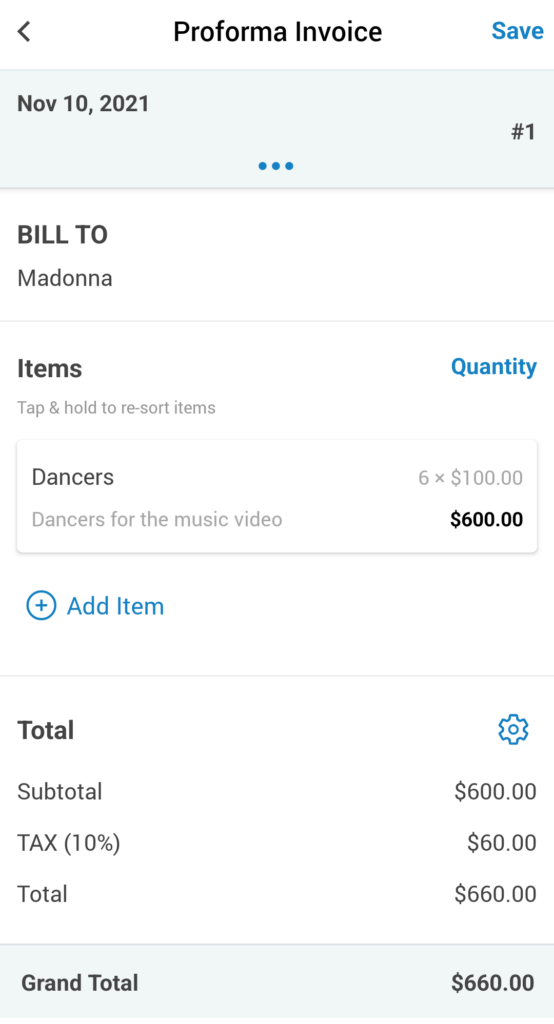

Step 2: Add details to your pro forma invoice

Enter the details of the goods and services you are providing.

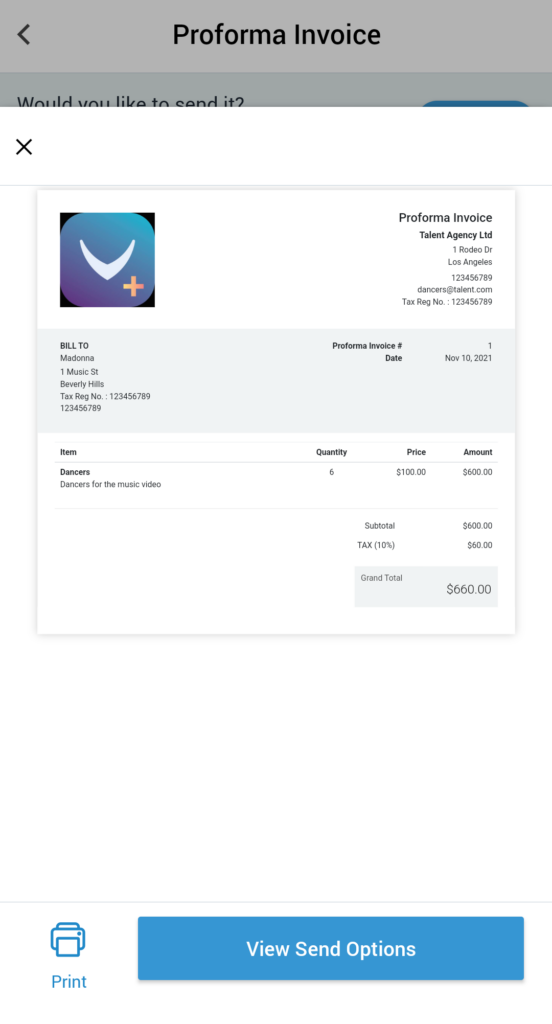

Step 3: Send your pro forma invoice to a client

Save and/or send the invoice to your customer.

What are the best practices for sending a pro forma invoice?

Sending a proforma invoice isn’t just about listing prices. It’s your chance to set the tone for a smooth, transparent transaction. Here are a few tips for handling pro forma invoices.

Be detailed and transparent

Make sure to include all costs right up front. Show unit prices, quantities, subtotals, shipping, taxes, and any extra fees. If you’re dealing with international clients, state the currency so everyone knows what to expect. Transparent pricing helps buyers feel confident and prevents payment surprises.

Use a professional template

Use a professional estimate template that reflects your brand. Add your logo, company details, and label the document “Proforma Invoice” at the top. This makes your business look polished and organized. Don’t forget to include a unique invoice number and the date for easy tracking and record-keeping.

Set clear payment and shipping terms

Clearly outline your payment and shipping terms. Let your buyer know which payment methods you accept and highlight any associated fees. Specify the shipping method and estimated delivery date. If there are customs or import requirements, mention those as well. Setting a validity period for your quoted prices keeps everyone on the same page.

Communicate proactively

Attach any supporting documents your buyer or customs might need. Send the invoice through secure channels to protect sensitive information. After you send it, follow up promptly to answer questions and confirm receipt.

Review and record everything before sending

Double-check names, addresses, prices, and calculations. Proofread for clarity and professionalism. Clear, error-free documents make your business look reliable and trustworthy. Keep copies of every proforma invoice you send. This helps you resolve disputes, track your sales process, and stay organized.

Start creating professional business documents in an instant

Bookipi offers a user-friendly invoice software and invoice templates that allow you to easily create professional invoices. Try Bookipi Invoice app for free to make pro forma invoices in minutes.

You can also download Bookipi Expense and budgeting app for free to track business and personal expenses.