Accept contactless payments in Australia with Tap to Pay

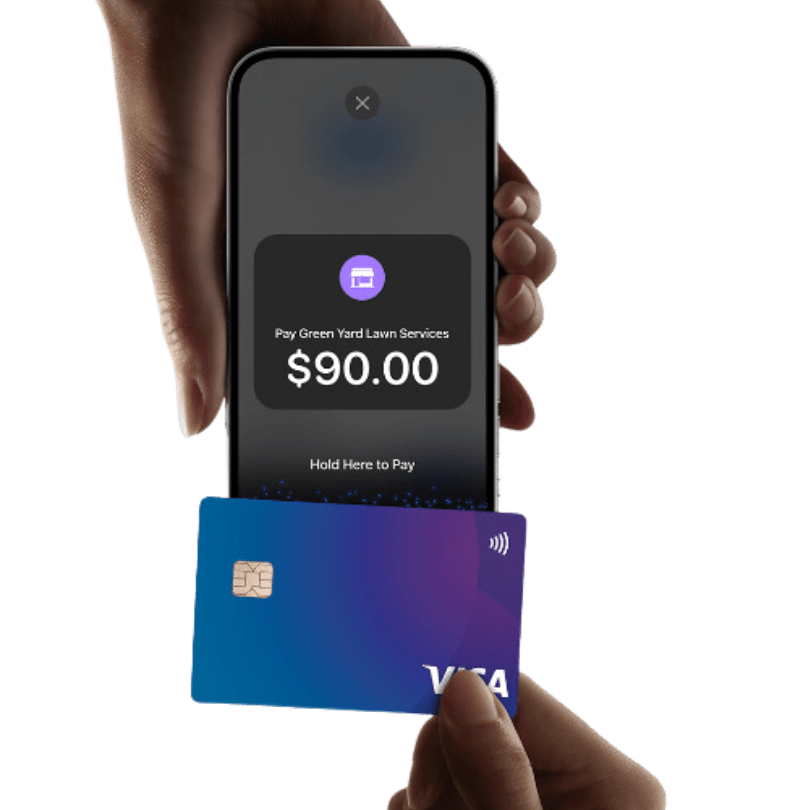

Accept payments in Australia with Tap to Pay on the Bookipi App. Utilising Near Field Communication (NFC) technology, accept payments directly from your device without an additional payment terminal or a POS system. Clients can easily pay you using contactless cards, Apple Pay, Google Pay, or other digital wallets with a simple tap.

Trusted everywhere by freelancers and businesses

Compatible with all major contactless cards and digital wallets

*Tap to Pay is currently only available in the United States, United Kingdom, Australia, New Zealand and Singapore.

More ways for your customers to pay you

with $0 monthly subscription and POS rental fees

How to set up and use Tap to Pay in Australia

Create an invoice

Tap to get paid

Know when and how much you get paid in one spot.

The first transaction may be delayed for verification purposes as part of our secure payments feature.

Receive contactless payments in Australia

➤ Tap to Pay simplifies your payment process for your customers, receive wireless payments for your services and/or goods just by using your iPhone or Android device.

➤ Get paid quicker by offering your customers a better and secure way to make payment in-person.

➤ Stop chasing payments and waiting for cheques to clear. Tap to Pay supports most digital payment methods in Australia.

How Tap to Pay works in Australia

➤ Tap to Pay utilises Near Field Communication (NFC) technology to process contactless transactions. When NFC is enabled, customers simply need to hold their compatible device (such as smartphones, smartwatches, and digital wallets) or contactless card to your device to make payment. It’s that simple and quick.

➤ Discover how we use Near Field Communication (NFC) technology for Tap to Pay, visit our FAQ section.

Frequently Asked Questions (FAQs) for Tap to Pay in Australia

How can I accept payment by using Tap to Pay?

To accept payments with Tap to Pay in Australia, you’ll need an NFC-enabled iPhone or Android device (including Tablets running on Android). Customers can tap their contactless cards or compatible devices against your device to initiate the payment process. Below are the steps to take to get started:

- Start by ensure that your device supports NFC (Near Field Communication) technology.

- Download our Invoice App on the App Store or Google Play Store.

- Once installed, create an invoice for your customer and select “Tap to Pay on iPhone/Android” from the “Payment” button.

- Receive payments by having your customer tap their preferred contactless cards or digital wallets (such as Google Pay, Apple Pay, Samsung Wallet and more) against your device and you’re set!

Paying and getting paid with Tap to Pay is quick, secure and easy, making it a popular alternative to cash payment.

Is Tap to Pay secure?

Tap to Pay offers a secure payment method for merchants and customers in Australia. With increased popularity in contactless payments, offering this option to your customers not only enhances their payment experience but also ensures faster, more secure transactions.

Transactions are encrypted, ensuring that sensitive payment data is protected during transmission. Additionally, both iPhone and Android devices incorporate security features such as tokenization and biometric authentication to further enhance security.

What payment methods work with Tap to Pay?

Tap to Pay supports various payment methods, including most credit cards, debit cards from major providers in Australia, and mobile wallets. Customers can also use compatible payment cards stored on their smartphones or tablets, such as Apple Pay, Google Pay and Samsung Pay, to make contactless payments via Tap to Pay. This flexibility enable you to cater to a wide range of customer preferences and payment methods.

Is Tap to Pay available on both iPhone and Android devices?

Yes, Tap to Pay functionality is available on both iPhone and Android devices. Both iPhones and Android operating systems support Near Field Communication (NFC) technology, which enables contactless payments. Users can receive payment using Tap to Pay on their smartphones and Android tablets – without additional hardware.

How does NFC work with Tap to Pay?

Near Field Communication (NFC) technology plays a crucial role for Tap to Pay, offering a convenient and secure way for you to receive contactless payment from your customers. Here’s how NFC works in the context of contactless payments:

- Initiation: When a customer taps their NFC-enabled device (smartphone or smartwatch) or contactless card near your NFC-enabled iPhone/Android device – the transaction process begins. Their device or contactless card acts as the initiator, sending out a radio frequency signal.

- Data Exchange: Your device, acting as the receiver, detects the signal from the customer’s device (or credit/debit card) and establishes a connection. This connection allows for the exchange of payment information between the two.

- Authentication: Once the connection is established, Our Tap to Pay functionality verifies with your customer’s device to authenticate the transaction. This authentication process verifies the legitimacy of the payment request and ensures that the transaction is authorized by the customer.

- Transaction Processing: After authentication, your device processes the transaction by securely transmitting the payment information to the relevant financial network or payment processor. This network verifies the transaction details, checks for available funds, and facilitates the transfer of funds from the customer to your associated account.

- Confirmation: Upon successful completion of the transaction, both the customer and you will receive notification of the transaction which you as the merchant will receive a “Approved” screen on the Bookipi app.

NFC makes Tap to Pay possible, allowing a quick and secure way to send and receive payment – making it a preferred option for payment transactions.

Is Tap to Pay available in other countries aside from Australia?

Currently, Tap to Pay is only available in Australia, the United States and United Kingdom. As we work to expand Tap to Pay to more countries, let us know where you would like Tap to Pay to be available next!

What are the fees associated with using Tap to Pay in Australia?

Below are the associated fees with Tap to Pay in Australia.

Australia:

- 2.2% + A$0.30 for domestic cards

- 4.0% + A$0.30 for international cards

+$0.15 per authorisation

*To understand the differences between standard and premium cards, visit here.

Make & send invoices on mobile app

Send invoices & receipts on mobile app (iOS & android) for free from anywhere ...

Learn more

Invoice generation software

Try sending unlimited invoices for free on web app & across all devices. Get online card payments ...

Learn more

FAQ on accepting card payments

Learn how to get paid from Bookipi Invoice on mobile app and web app ...

Learn more