Many small business owners need to send invoices. You can accept a variety of payment methods, depending on what suits you, your business, and your clients.You want to make payments as easy as possible for your clients.

This can be done by picking multiple payment methods or asking the client their preferred payment method.

Whatever payment method(s) you choose, you should have clear instructions on how the client can make the payment.

Keep in mind that each country has slightly different payment systems and payment rates, and individual research should be conducted so that the most appropriate methods can be used.

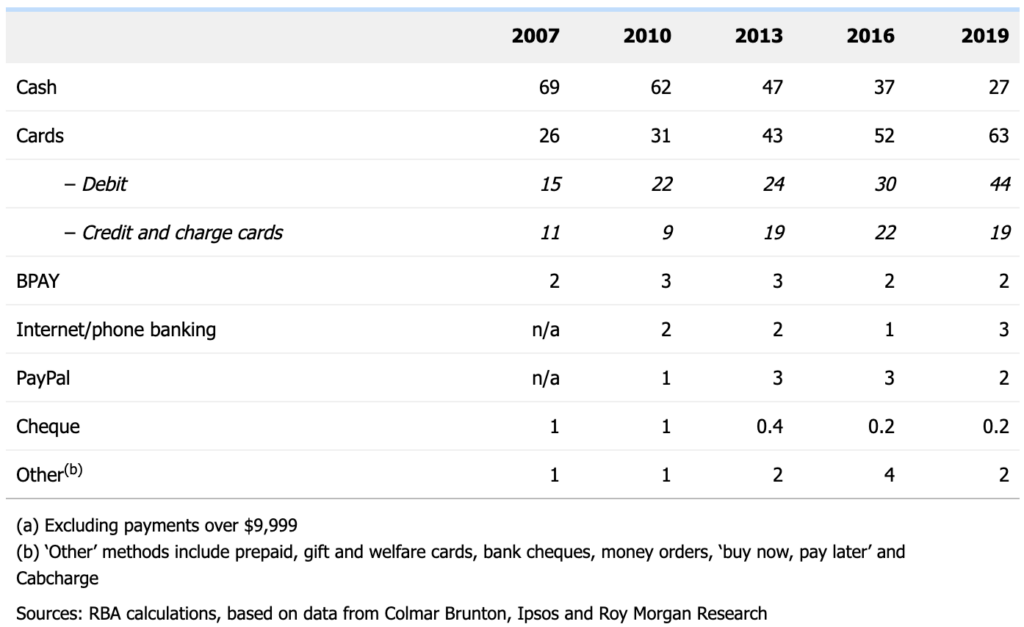

Consumer payment methods (%)

Based on the findings in the Reserve Bank of Australia’s 2019 Consumer Payments Survey, conducted by Roy Morgan Research

Source: Reserve Bank of Australia

Types of payment methods your business can use

Accepting cash as payment

Pros of accepting cash

- One of the easiest forms of payment

- No transaction fees

- No processing time

Cons of accepting cash

- You’re more likely to have your taxes audited by the government

- Least secure method. Vulnerable to being misplaced or stolen

- Keeping track and counting cash at the end of each day can be time-consuming

- Keeping cash stocked with bills can stop you from using that money in other ways for the business

Accepting debit or credit card payments

Pros of accepting credit card payments

- Quick and convenient for customers

- Customers can safely make large purchases

- You don’t need to keep large cash quantities on premises

- Contactless payment method

- Accepting debit/credit card payments can boost sales, increase cash flow and improve the overall customer experience

Cons of accepting credit card payments

- Longer processing time (usually between 1-3 days)

- Transaction fees

- Need to set up a merchant gateway or a Point-of-sale (POS) device to accept payments. An easy alternative is using Bookipi’s integrated online card payments in our invoice software.

Accepting mobile payments

Pros of accepting mobile payments

- Convenient payment method, particularly for companies conducting their business on-site such as tradesmen.

- Relatively fast payment option

- Credit cards often have rewards programs which rewards clients with points.

- You don’t have to carry cash or a card/wallet. The ability to pay is on your mobile phone or smart watch.

Cons of accepting mobile payments

- Transaction fees

Accepting cheque payments

Pros of accepting cheque payments

- No transaction fees

- Can be written up at any time.

Cons of accepting cheque payments

- Long processing times

- Cheques can ‘bounce’ if the customer doesn’t have sufficient funds. You won’t receive payment.

- Inconvenient as the ‘float time’ between when the cheque is written and when it is cashed can vary greatly.

- Vulnerable to scammers stealing your information, or modifying the amount on the cheque and wiping out your account.

Accepting payment by bank transfer

Pros of accepting bank transfers

-

- No transaction fees

- Customers can safely make large purchases.

- Can be a quick method of making payments.

Cons of accepting bank transfers

-

- Customers may not feel comfortable transferring directly from their account.

- Transaction processing time.

- You may need to set this transaction type up with your bank and your customers.

Accepting automatic transfer payments

Pros of accepting automatic transfer payments

-

- Great for payments you either charge for regularly, or need to pay regularly.

- Avoids late fees.

Cons of accepting automatic transfer payments

-

- Could overdraw your account which can lead to overdrawn fees.

- Much easier to miss any billing errors.

Accepting online payments

Pros of accepting online payments

-

- Extremely quick to conduct and for the money to be processed.

- One-click payment such as Apple pay make it a very easy tool to use. Apple pay is quickly becoming one of the most popular ways to make in-person payments. In the UK in 2018, 62% of all payments were electronic (Let’s be game changers 2019).

Cons of accepting online payments

-

- Vulnerable to technical issues. Poor internet connection can disable online payment methods.

- Risk of fraud and theft. As more and more people choose this method of payment, criminals are becoming more advanced in the ways they interfere with transactions and steal people’s money and information.

What to consider when choosing your payment methods

There’s no perfect payment method for everyone. All the methods available to small business owners have their positives and their negatives. You’ll need to look at your business and the clients that you deal with. Some things to keep in mind include:

Costs

Costs including service and transaction fees. You might also have to pay for hardware if you choose a physical processor or labour costs if you need to hire someone to handle cash.

Customer preferences

Knowing your market and what payment methods your clients prefer will help them pay on time. You want to make paying invoices easy for them so think about their technical skills and if they ask for a particular payment, consider catering to their needs.

Reliability

If you want to use payment methods that require an internet connection, but you work in locations with unstable internet, it would be wise to have a back-up method. If you’re far away from a bank, you probably won’t want to choose a method that requires physical banking. Think about your limitations and work within them.

Risks

Evaluate the risks of each payment method. Do some have a higher chance of experiencing hackers or theft? Which methods have buyer protection and fraud security? Consider both online security and physical security.