Release of Liability Form

A release of liability form is a document used to waive any future claims or disputes against a specific party or entity. Discover how to create a Release of Liability Form with AI.

And with Bookipi’s eSign, have a Release of Liability Form signed digitally on our mobile or web app. Try it out!

Alternative to Contract templates

There are faster ways to draft a contract and getting it signed online. Hi there, meet AI Contracts.

Generate a legally binding contract in minutes, customize it to your terms and send it for eSignatures – without ever changing tabs. Try it out!

Best AI-powered document generation tool to draft (and sign) contracts

Simply faster and better

Instead of starting from scratch or paying high legal fees, AI Contract walks you through a guided process to build contracts for you.

Improved accessibility

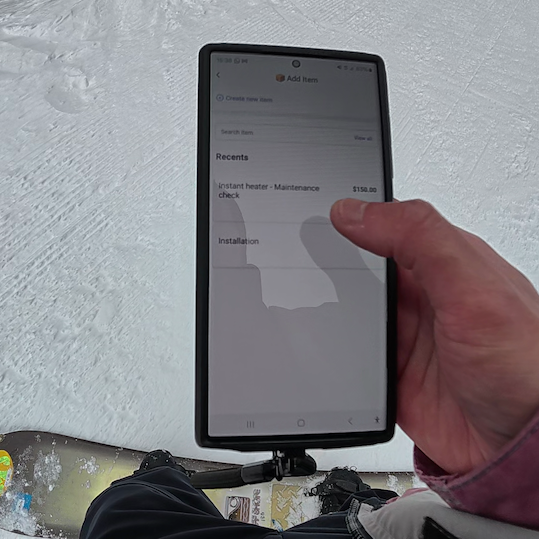

Sign or request for digital signatures from anywhere, anytime. Get digital signing on mobile devices or desktop.

Effortless collaboration

Multiple parties can sign a document concurrently with our digital signatures.

What is a Release of Liability form?

A release of liability is a legal document that excuses one party from any responsibility or liability for potential damages, injuries, or losses that may occur during an activity or transaction. This document is often used in situations where there is a risk of potential harm or injury, such as participating in a physical activity (like bungee jumping, scuba diving etc.) or using a company’s services.

By signing a release of liability, individuals are agreeing to waive their right to hold the other party accountable if something bad happens. It is important to read and fully understand its terms before signing because it can affect your ability to seek compensation for any damages or injuries that occur.

How to manually create a Release of Liability form

Creating a release of liability is an important aspect in ensuring the protection of your business. Follow these three steps to draft one that safeguards your interests:

Identify The Parties:

Clearly identify the parties involved in the release. This includes the company or individual releasing liability and the party being released from liability. Be sure to include their full names, addresses, and any relevant contact information.

Outline The Scope:

Specify the liabilities being released, whether related to a specific transaction, the activity or ongoing business. Describe the risks waived and consequences of the release in detail.

Obtain The Signature:

Have all parties involved sign the release of liability document, including a witness signature if it’s required by local laws. Signatures from both parties indicate their agreement to the terms and conditions outlined in the release. This creates a legally binding agreement that can help protect your business in the event of any disputes or claims.

By following these steps, you’ll create a clear, thorough, and legally sound release of liability, offering peace of mind and protection from potential liabilities.

With AI Contract, you can instantly generate unique, customizable contracts tailored to your specific requirements, and get them signed online with eSign – convenient!

Purchase Order Form

A purchase order form is a document used in accounting to request and authorize the purchase of goods or services from a vendor.

Sales Agreement

A sales agreement is a legal document used in business transactions to outline the terms and conditions of a sale between a buyer and seller.

Service-Level Agreement (SLA)

A service-level agreement (SLA) is a contractual document outlining the level of service a provider will deliver to a client.

Employment Contract

An employment contract is a legal agreement used in human resources to outline the terms and conditions of employment between an employer and employee.

Employment Offer Letter

An employment offer letter is a formal document used in human resources to extend a job offer to a candidate.

Non-Disclosure Agreement (NDA)

A Non-Disclosure Agreement (NDA) is a legal document used to protect confidential information shared between parties.

Confidentiality Agreement

A confidentiality agreement is a legal document used to protect sensitive information shared between parties from being disclosed to unauthorized individuals.

Partnership Agreement

A partnership agreement is a legal document that outlines the terms and conditions of a partnership between two or more parties.

Loan Agreement Form

A loan agreement is a legal document used to outline the terms and conditions of a loan between a lender and borrower.

Franchise Agreement Form

A franchise agreement is a legal document that outlines the terms and conditions under which a franchisee can operate a franchised business.

Lease Agreement

A lease agreement is a legal contract between a lessor (the owner of an asset) and a lessee (the individual or business leasing the asset) that outlines the terms and conditions of the lease arrangement.

Independent Contractor Agreement

An independent contractor agreement is a legally binding document between a business and a contractor outlining the terms and conditions of their working relationship.

Distribution Agreement

A distribution agreement is a legal contract used in business to establish terms and conditions for the distribution of products or services by a manufacturer to a distributor.

Retainer Agreement

A retainer agreement is a contract between a client and a professional service provider, such as an accountant or lawyer.

Release of Liability Form

A release of liability form is a document used to waive any future claims or disputes against a specific party or entity.

Frequently Asked Questions (FAQs) on Release of Liability Form

What is a release of liability form, and why is it important?

A release of liability form is a document where one party agrees not to hold another party responsible for any harm or damage. It is important because it protects against legal claims and helps prevent lawsuits. This form is often used in activities with some risk, like sports or events, to ensure participants understand the risks involved. Between businesses, it protects the provider or supplier against claims that may arise from the clients’ use of the goods or services.

When should a release of liability form be used?

A release of liability form should be used in accounting whenever a business is engaging in activities that could potentially lead to risks or liabilities, such as contracting services, hosting events, or providing certain products. It is important to have participants or clients sign this form to protect the business from any unforeseen legal issues.

What information should be included in a release of liability form?

A release of liability form should include the names and contact details of the parties involved, a detailed description of the activity or service, a clear statement that the releasing party agrees not to hold the other party liable for any harm or damage, and the date and location of the agreement. It should also outline any exceptions or limitations to the release, and both parties should sign and date the form to confirm their agreement.

Can a release of liability form avoid all legal liabilities?

While it offers some protection, it’s not foolproof. It is still important for businesses to operate ethically and professionally, and to have proper insurance coverage in place to protect against unforeseen risks and liabilities.

Are release of liability forms legally binding?

Yes, release of liability forms are legally binding documents, as long as they are properly drafted, signed by all parties involved, and comply with applicable laws and regulations. It is essential to consult with a legal professional to ensure that the form is valid and enforceable in a court of law.

Consider using eSign for release of liability forms for easy management – you’ll ensure that all parties will have a copy of the validated form and it also serves as a digital backup. Try eSign out for free!

*Information provided on this page are for informational purposes only and do not constitute legal advice. While Bookipi strive to ensure accuracy, we make no guarantees regarding the suitability or completeness of this resource. If unsure, it is recommended to consult with a qualified legal professional before creating a template on your own.

*Information provided on this page are for informational purposes only and do not constitute legal advice. While Bookipi strive to ensure accuracy, we make no guarantees regarding the suitability or completeness of this resource. If unsure, it is recommended to consult with a qualified legal professional before creating a template on your own.

Bookipi Invoice mobile app

Send invoices & receipts on mobile app (iOS & Android) - from anywhere ...

Learn more

Proposal AI

Create professional, brand-aligned proposals in minutes with a simple AI prompt. ...

Learn more

AI Website Builder

Generate your website with AI, add pages and customize it to your brand. No coding required, and hosting included ...

Learn more

Get started in minutes

5-minute setup, no credit card needed.