Home » Small Business Bookkeeping » Page 3

Small business bookkeeping made simple

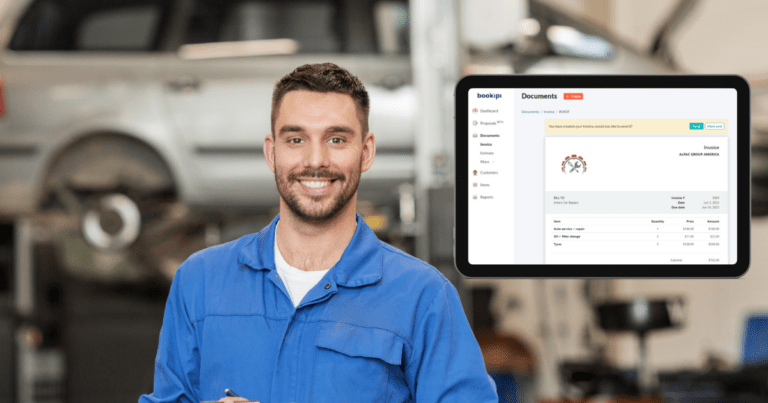

Trying to juggle client work, marketing, and invoices at once? If you’re like most small business owners, bookkeeping probably isn’t your favorite part of the job. But staying on top of your numbers is what keeps your lights on and stress levels low.

In this hub, you’ll find resources that explain exactly what small business bookkeeping involves, why it causes so many headaches for small businesses, and how AI-driven small business management tools like Bookipi can turn chaos into clarity.

How do I start bookkeeping for my small business?

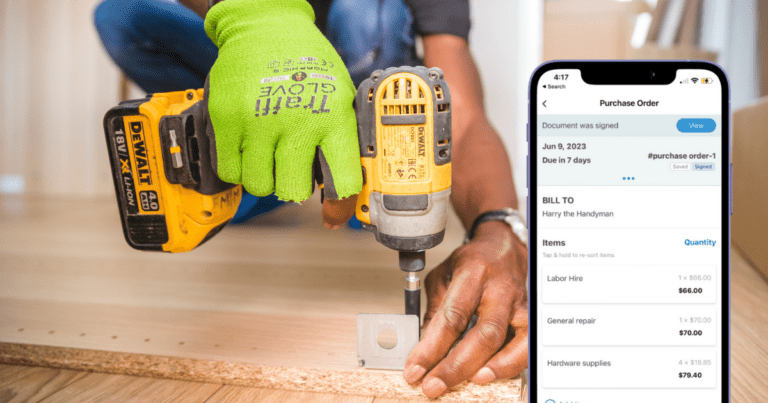

Keep a detailed record of all business-related purchases to track spending and prepare for taxes.

Regularly log every financial transaction to maintain accurate and up-to-date books.

Review your income and expenses to ensure your business has enough cash to operate smoothly.

Bookkeeping resources for small businesses

Accounting for freelancers: a complete guide to bookkeeping for the self-employed

The importance of tracking equipment maintenance for landscaping businesses

Small business bookkeeping FAQs

What’s the difference between bookkeeping and accounting?

For small businesses, bookkeeping records transactions, and accounting turns that information into financial insights. Both play a massive role in managing your business money well. Think of bookkeeping as the daily record-keeping of your financial world. It’s where you:

- Track every business transaction

- Record invoices, expenses, income, and payments

- Stay on top of receipts and categorize spending

Accounting takes that data and turns it into financial insights for smarter decisions. It usually involves:

- Reviewing financial statements to gauge business health

- Analyzing trends over time, like profit margins and cash flow

- Filing taxes based on accurate financial records

What bookkeeping terms should every small business owner know?

The vocabulary can feel like another language. Here are a few must-know terms that’ll help everything start to make sense:

- Assets: Stuff your business owns that has value, like cash, equipment, or inventory

- Liabilities: Debts your business owes—like loans or unpaid invoices

- Equity: What’s left after subtracting liabilities from assets—basically, your ownership in the business

- Transactions: Any financial activity like a payment made, invoice sent, or deposit received

- Income: Money you make from selling goods or services

- Expenses: What you spend to run your business—think software, rent, materials, etc.

Knowing these terms helps conversations with your accountant (or your tax software) go a lot smoother. Plus it gives you confidence to dig into your numbers instead of avoiding them.

How do I easily manage the bookkeeping for my business?

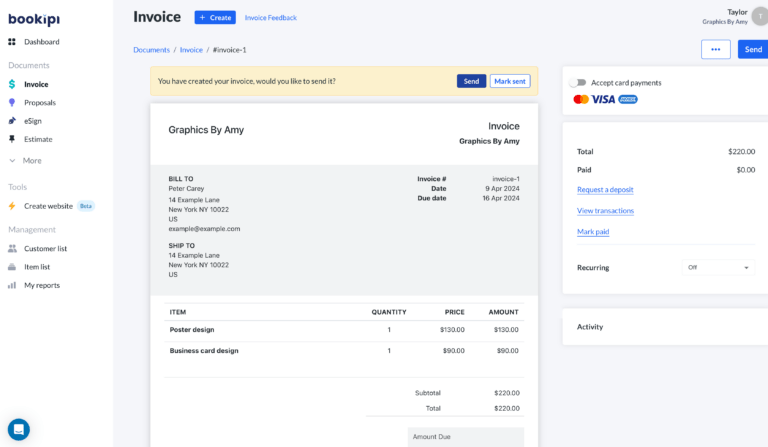

- Use a small business management tool that ties your invoicing with your other workflows. With Bookipi, for example, you can manage your leads, generate proposals, and send invoices that connect to an expense tracking database. No extra steps or apps.

- Set clear income categories (freelance writing, coaching, digital downloads) and expense types (software, advertising, subcontractors) so you’re not scrambling at tax time.

- Track everything in one place. A single dashboard that shows invoices, payments, expenses, and profit makes your money easier to manage. When you see patterns in your accounting, you can make smart decisions faster.

The more your system reflects how you actually work—hourly gigs, client retainers, or one-off sales—the less bookkeeping feels like a chore.

How do I build a monthly budget that works for small businesses or microbusinesses?

Forget cookie-cutter corporate budgets. Freelancers need flexible, responsive plans built for real cash inflows. Here’s how I go about creating my freelance budget:

- Start with fixed monthly expenses: Rent, website hosting, software subscriptions, phone service—list them all. They don’t change, so they’re your baseline.

- Estimate your average revenue per month: Look at the last 3–6 months and get your average take-home after fees and taxes.

- Add a personal income line: This is what you want to pay yourself. Treat it as a non-negotiable expense so you don’t end up working for free.

- Set aside money for taxes: I usually set aside 25–30% into a separate savings account so I’m not scrambling every quarter.

- Create a buffer or emergency fund: Even $200/month helps offset slow seasons or a missed payment from a client.

Still feel overwhelmed? Bookipi offers an expense tracking tool sorts this stuff on autopilot—categorizing your transactions, giving you summaries, and showing patterns over time so you can base your budget on facts, not guesswork.

Should a small business have a dedicated bookkeeper?

It depends on how much time you have, how comfortable you are with numbers, and where you want to focus your energy. If your business is growing, and you’re short on time, hiring a bookkeeper might be your next best move. Bookkeepers don’t just crunch numbers. A solid one keeps your finances organized, prepares reports, stays on top of invoicing, and can even help forecast cash flow.

Still, doing your own bookkeeping can save you money, especially if you have a simple operation or are just starting out. If all you need is basic income and expense tracking folded into an all-in-one business management tool, apps and software like Bookipi could cover everything without needing to hire anyone.

Get started in minutes

5-minute setup, no credit card needed.