To make an invoice, you need all the information relevant to the payment the invoice is for.

This includes your business details, the client’s business details, an outline of the services, their associated costs and the terms of the payment. Using an invoice software like Bookipi allows you to easily reuse service items and customer information without the need to recreate them on new invoices.

Knowing what goes into an invoice and how to make one is important as it affects what you will get paid.

To help you out, in this article, we will go over what is an invoice, their importance, and ways to make an invoice.

Before making an invoice

An invoice is a document that is sent to a buyer from a seller. On an invoice, you will see a list of the goods or services provided, the associated costs, the payment terms and who the transaction is between.

Check out our other post for a full description of what is an invoice.

Why are invoices important?

Invoices are an essential part of the payment process.

An invoice helps the seller to get paid. It outlines the details of the sale for the buyer so they can make the appropriate payment.

Without an invoice, the buyer doesn’t know what to pay the seller and when to pay them.

It also helps the seller to track their income and business transactions.

How to create an invoice (Step-by-step)

You’ll need all of the following information to write an invoice:

1. Your business information

At the top of your invoice, you’ll want to include all the contact and business information of you and your business.

This includes your name or business name, phone number, email, address, business number and tax information.

You can also include your logo in this section if you have one.

2. Your clients’ details

You also should include your client’s details. This will help you with organising your invoices and managing your clients.

In this section, you should add the name of your client or their business’ name, their phone number, email address, business number (if applicable) and their tax information.

3. Invoice information

Your invoice information regards how you organise your invoices. This means a unique invoice number for each invoice that follows a set numbering system.

You will also want to include the date that you issued your invoice. Having clear invoice information will help you to better manage your invoices and help you track how long after the issue date is an invoice paid.

4. Payment terms

The payment terms are an agreed-upon set of terms that specify how the client will pay you.

This includes the payment method the client must use (bank transfer, credit card, etc.), the payment due date, how you have staged the payment (one-time, an initial deposit with full payment due after project completion, etc.), and the payment due date.

In this section, you can also add any additional fees that might be incurred because of late payment.

5. Itemized list of products and services

The next part you should add is an itemised list of the products and/or services you are providing.

Make sure to break down every single part of the services/products you are providing so the client is completely clear about what they are paying for.

The details you should include:

-

- A short description of each product/service provided

- The quantity of the service/product

- The rate for one unit of the service/product

- Subtotals for each product/service

- Total for all services/products provided

6. Taxes

Depending on where you live and the type of business you own, your services/products might be subject to tax.

If this is the case, you will need to include the associated taxes on the invoice and whether it is included in the services or charged on top.

7. Notes

Notes are not a necessary part of the invoice but if you have any additional information for your client, you can include it on your invoice.

You could also include a personal message in the notes section.

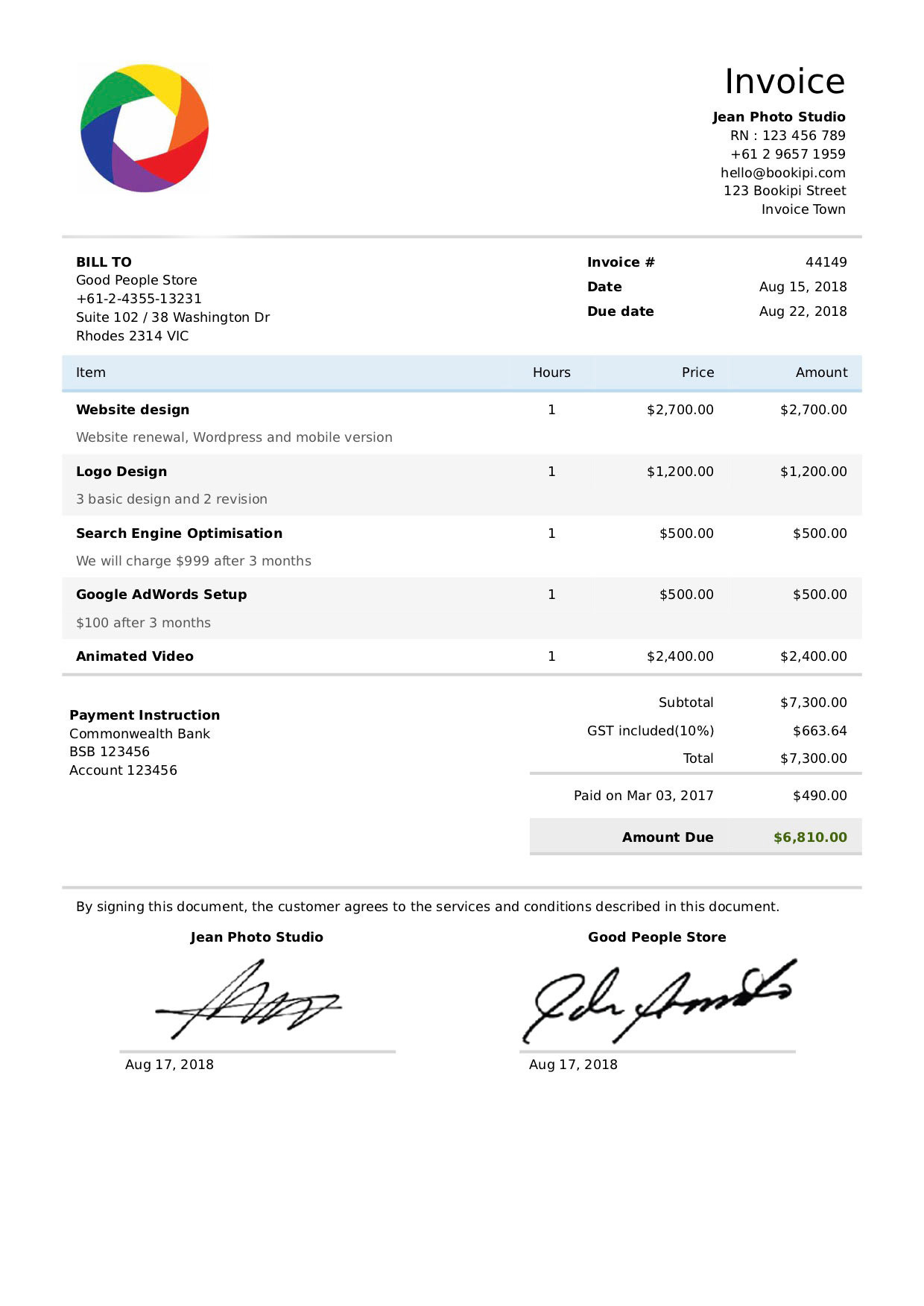

Example of an invoice

Below we have a sample of an invoice generated with Bookipi Invoice.

How should I format an invoice?

In terms of formatting invoices, you can follow the guidelines below or check out our free invoice templates:

- At the top of the invoice, you can include your business logo and business details including business name, registered identification number, phone number, email and address.

- In the next section, you can add customer information like the customer’s business name, phone number, business number, email address and physical or shipping address.

- Add a section for invoice information including invoice number, the issue date and the due date.

- Add an itemized summary of goods and services provided in the next section. Provide a list of all goods and services provided, the quantity in units or hours worked, the cost per unit and subtotal amounts.

- Add payment instructions and amount owing by the customer for payment in the next section. Payment instructions should include the preferred method of payment and account details for bank transfers if required.

- Include a final invoice total due or payable including the subtotals, any taxes, and deductions for any previous payments made.

- You can also add a signature section for the buyer and seller to sign. This acknowledges that both parties agree to the terms and conditions of the invoice and that it’s a correct representation of the transaction.

What can I use to make a business invoice?

There are a few different tools that you can use to make an invoice, depending on the complexity of your invoice and your price range.

You can use a free invoice template to make invoices in Microsoft Word or Excel. Similarly, if you are a Google Suite user, you could use Google Docs or Google Sheets to create invoices. Using invoice templates can be a good solution if you have simple invoice needs or if you only send invoices occasionally.

If your invoices are a bit more complex, you send them regularly or you want them to look a bit more professional, it can be a good idea to use invoicing software like Bookipi. Invoicing software is available on desktop and mobile devices.

What are the best ways to make a business invoice?

The best way to depends on your business. Factors that can impact the best invoicing option for you include your budget, the size of your business, the frequency that you invoice and the amount of time you commit to generate an invoice.

Bookipi is a good option for small businesses looking for an invoice software. Bookipi Invoice is free for all small businesses and it lets you send professional invoices to your clients. You can also use it to accept payments from your clients! Bookipi is available on both web and mobile app (iOS, Android and Huawei)

For easier and faster invoicing on the go, try Bookipi Invoice for free.

What is the quickest way to invoice?

Using an invoice software like Bookipi is the quickest way to invoice when you’ve set up your account. You can reuse (or insert new) service items, customers, your company information and other necessary details on a new invoice without the need to recreate them. Add due date reminders for your customers, request for deposit, set payment terms, get eSignatures and more!

Can I create an invoice in Word?

Yes, you can. We’ve created invoice templates for Word that you can download and edit. However, creating an invoice on Word can be frustrating – frequently with adjusting layouts if you have multiple service items. Creating and sending an invoice with Bookipi is a better alternative, our mobile app ensures that you can even do it from your device.

How do I make an invoice in Excel?

To create an invoice template in Excel, begin by either opening a new Excel spreadsheet or import one of our free Excel invoice templates. Adjust the template to include a header featuring your company’s name and address, a section for your customer’s particulars, a breakdown of provided goods or services, pricing details, tax calculations, and the total amount payable. Once formatted, you select ‘Save As’ to save your invoice in the desired format for sending.